IntentX investment thesis

An investment thesis for perpetual DEX IntentX using the Sequoia Capital investment framework

Abstract

IntentX is a non-custodial exchange that offers the trading of perpetual contracts via an intent-based order-matching model. The exchange has facilitated $1.3B in trading volume in late 2023, with close to $500M over March 2024 alone. IntentX is founded by levy and Roux, and has raised $4.3M from Selini Capital, the Mantle Foundation, Magnus Fund, and others. I anticipate an increase in adoption following the implementation of one-click trading, and also as airdrop farmers begin to migrate away from other perpetual exchanges following their token launches. I also expect a growing strategic pivot toward the Mantle ecosystem, driven by Selini CIO Jordi Alexander.

Table of contents

1. Background

1.1 What is a perpetual exchange?

Perpetual exchanges facilitate the trading of perpetual futures contracts, the single most popular trading instrument in crypto. Since the introduction of XBTUSD perpetual futures by Arthur Hayes, BitMEX co-founder, in 2016, perpetual futures have become an irresistible attraction for crypto traders. [1] The popularity stems from the leverage these contracts offer combined with their time-resilient exposure to cryptoassets.

Perpetual exchanges can be largely categorized into two groups - (1) DEXs such as IntentX and dYdX which are built on blockchains, and (2) CEXs such as OKX and Binance which do not operate on blockchains (but may have separate products that do).

1.2 How do perpetual DEXs work?

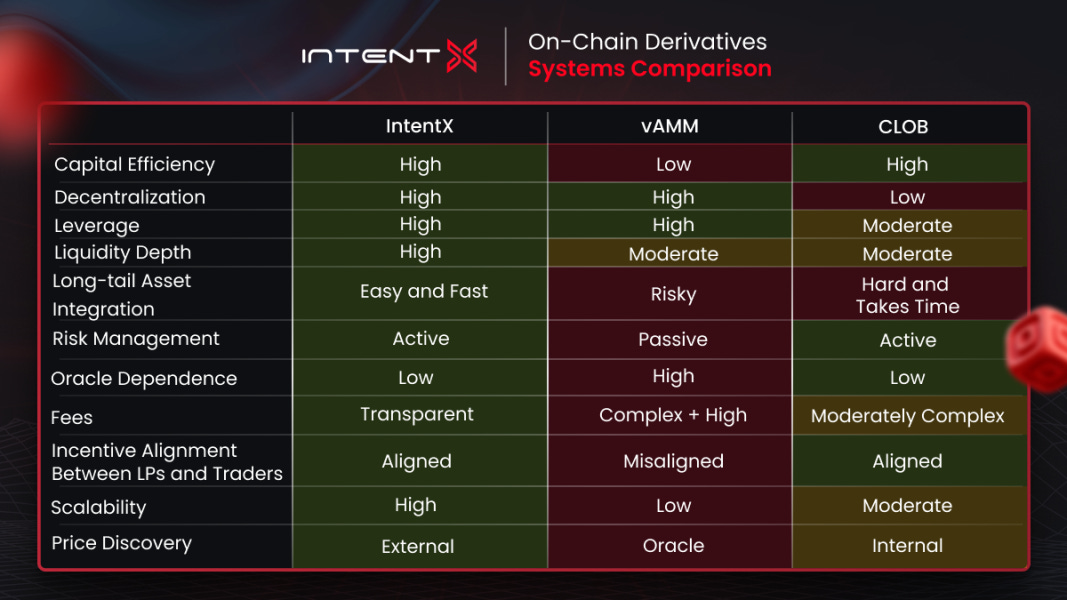

There are three major types of perpetual DEXs - (1) automated market makers (AMM), (2) traditional order books, and (3) intents. In AMMs, traders borrow and trade against rely on liquidity pools provided by liquidity providers. Traditional order books operate similarly to CEXs with clear bid-ask orders. Orders are matched by an offchain matching engine and settled onchain afterward, as order books are generally too computationally intensive for blockchains. Intents are OTC and P2P-based trades, where a trader submits an intention to open/close a trade with several parameters (asset, execution price, leverage, etc), and a market maker takes the trade in the opposite direction.

1.3 Why are perpetual DEXs important?

DEXs allow for the leveraged speculation of digital and real-world assets alike. Traders can use these exchanges to make bets on the volatility of an asset.

1.4 When did the perpetual DEX market emerge?

Perpetual DEXs emerged in late 2019 with dYdX, the current market leader based on trading volume. Competitors such as GMX and Perpetual Protocol then followed in early 2021. [2]

Figure 1: Monthly trading volumes of perpetual DEXs [3]

1.5 How much in trading volume do perpetual DEXs and CEXs facilitate?

On March 24, 2024, the 24-hour trading volume across centralized and DEXs was $253B. [4] Only $6.5B of this total volume was driven by DEXs, indicating a large skew towards their centralized counterparts. [5]

2. Purpose

IntentX is an onchain perpetual exchange that aims to combine the best elements of DEXs (fully onchain and self-custodial) with those of CEXs (superior liquidity and user experience), via just-in-time trades executed by external solvers. With this novel trading architecture, IntentX claims to provide 100x better capital efficiency than existing vAMM DEXs, while also eliminating capital lockups for market makers.

3. Problem

The problems with the current perpetual trading landscape can be broadly categorized into two types:

3.1 Problems with CEXs

CEXs, by nature, take control of a user’s funds once the assets have been deposited on the exchange. In the case of dishonest or inadequate management of funds by these exchanges, all user deposits are at risk. In November 2022, major CEX FTX was revealed to have lost $9B in customer deposits. [6] As a result, there has been a growing number of traders (especially crypto-native ones) migrating from CEXs to DEXs for the safety of self-custody.

3.2 Problems with DEXs

DEXs generally suffer from three main issues - (1) high fees, (2) low trade execution speeds, and (3) low selection of tradable pairs.

In the case of major perpetual exchange GMX v1, traders are required to pay 0.1% of their total notional volume in fees to open or close a position. [7] Although this cut was lowered to ~0.07% in GMX v2, this is still significantly higher than fees taken by centralized exchanges such as Binance or OKX, where the taker fee rates generally range between 0.02 and 0.05%. [8] [9]

On top of this, DEXs are subject to the structural limitations of blockchains, which are only able to finalize transactions based on the speed of the network itself. On some blockchains where the current transactions per second range from 1-5 seconds, this presents a significant issue for leveraged traders that require pinpoint execution of positions. [10]

Figure 2: Number of perpetual trading pairs per exchange, as of March 24, 2024

The number of tradable pairs for DEXs is also limited, with GMX v2 and dYdX v4 only offering 15 pairs and 60 pairs, respectively. [11][12] This is typically due to the lack of asset price oracles, which are used to fetch reliable asset prices onchain at regular intervals. To put this into perspective, OKX and Binance have over 464 and 358 perpetual pairs available for trading, respectively. [13][14]

4. Solution

IntentX is a perpetual exchange built on Base, Blast, and Mantle that combines the non-custodial nature of DEXs with the superior user experience and liquidity of CEXs. It achieves this by using intent-based trading architecture, where a trader submits an intention to open/close a trade with several parameters (asset, execution price, leverage, etc). A market maker opens up the trade in the opposite direction, resulting in a bilateral trade agreement between the two parties.

This model allows market makers (known as solvers in IntentX) to provide customized quotes to traders, resulting in deeper “just-in-time” liquidity for traders. For solvers, no capital lockup is required since the liquidity is provided only when it is needed, unlike in other platforms where market makers may, for example, have idle liquidity for BTC at $10K even while the price hovers at $70K.

Figure 3: IntentX’s solution compared to vAMM and order-book DEX models [15]

4.1 Non-custodial

As user funds are deposited into transparent smart contracts, users retain control over their funds and can easily withdraw assets to the safety of their wallets at all times.

4.2 Low trading fees

IntentX charges 0.03% of notional volume as a platform fee, amongst the lower end of perpetual DEXs and comparable to most CEXs. [16]

4.3 Wide pair availability

IntentX currently supports the trading of more than 250 markets, an order of magnitude higher than competitors like GMX (15 pairs for v2) and dYdX (60 pairs for v4). [17]

5. Why now?

Both perpetual CEXs and DEXs generally see increased activity when asset prices are volatile, as traders can potentially generate larger profits with less upfront capital. As prices of tokens have increased significantly across the board over Q4’23, open interest (total value of unsettled positions) on CEXs/DEXs have also surged in USD terms.

Figure 4: Open interest and volume across major CEXs and DEXs [18]

When combining improved market conditions and IntentX’s advantageous features listed in the Solution section above, IntentX has been growing rapidly. The protocol has achieved $500M of its cumulative $1.3B trading volume within the last 30 days, attracting approximately 400-500 users per day. [19]

Figure 5: Daily notional trading volume on IntentX [20]

Figure 6: Daily active traders on IntentX [21]

6. Market size

On March 24, 2024, over $253B in perpetual trading volume was facilitated across CEXs and DEXs, where DEXs accounted for only $6.5B (2.6%) of this volume. [22] [23] The vast majority of trading volume currently still occurs on CEXs, due to the ease of user onboarding, relatively low trading fees, and flexibility with advanced order types (i.e. stop loss, take profit).

Figure 6: Comparison of 24-hour trading volume across derivatives exchanges, as of 24 Mar 2024

Within the DEX sector, the still-nascent IntentX currently holds approximately 0.2% market share, having facilitated just over $13.2M in trading volume over the same 24-hour period. [24] Volumes will likely rise rapidly as larger DEXs like Aevo and Hyperliquid launch their tokens, and airdrop farmers turn their attention to smaller platforms like IntentX.

This dynamic has already been playing out with Aevo, which launched its AEVO token on Mar 13. Trading volumes have seen a steep decline from Mar 4 onward, suggesting that the mercenary airdrop farmers have moved on to newer protocols.

To capitalize on this rotation, IntentX has launched a 3-in-1 point earning program for traders, consisting of INTX points, CORE points, and BLAST points. [25] Using Aevo and Hyperliquid as a benchmark, the projected daily trading volume could be at ~$650M-$1.3B (50-100x growth) as this rotation plays out, especially following the launch of the Hyperliquid token.

Figure 7: Aevo weekly trading volume, as of 24 Mar 2024 [26]

7. Competition

IntentX’s competitors can be categorized into two main groups - DEXs and CEXs, although DEXs are the more direct competitors for onchain traders.

dYdX is currently the market-leading perpetual DEX by trading volume, while GMX leads by fees generated due to their higher take rate. While IntentX is much more nascent than these leading platforms, it has been exhibiting a positive growth trajectory, which will be aided further by its 3-in-1 airdrop points system.

Figure 8: Key metrics of IntentX and major DEX competitors dYdX, Hyperliquid, GMX, and Aevo [27] [28] [29] [30]

8. Product

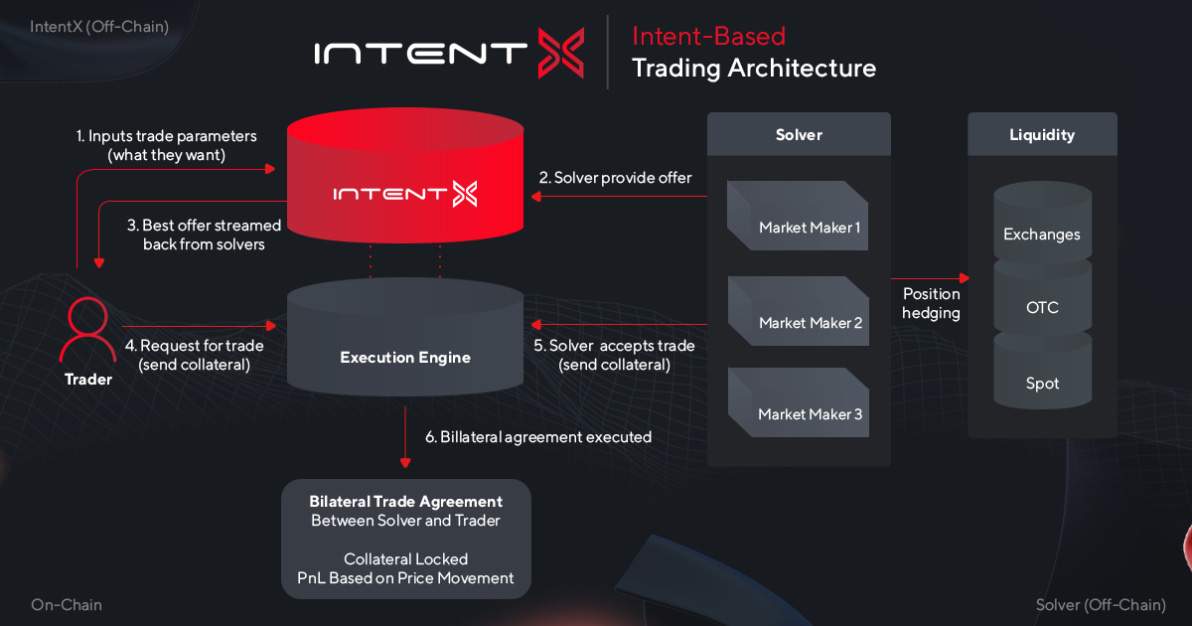

IntentX’s main innovation lies in its intent-based trading architecture, which uses its strategic partner SYMMIO under the hood. [31] A typical trade is executed via the following steps:

[Offchain] A trader submits a trade on the IntentX website.

[Offchain] External solvers (market makers) provide a quote to the trader, displaying the conditions that the trade will be executed at (price, slippage, fees, funding rates, etc.).

[Offchain] IntentX selects the best quote for the trader. This is an automated process, meaning that the trader.

[Onchain] The trader sends a “Request to Trade” to the solver and locks up the required collateral into a smart contract.

[Onchain] The solver accepts the trader’s “Request to Trade” and deposits an equivalent collateral for the opposite direction into the contract.

[Onchain] A bilateral agreement between the solver and the trader is formed and exists until the trader closes the position or is liquidated. The position is isolated and symmetrical, where one party pays the other depending on the price movement of the underlying asset being traded.

Figure 9: IntentX’s trading architecture flow chart [32]

IntentX has also placed a high focus on improving user experience. The protocol introduced a progressive web application (PWA) to onboard mobile users and provides detailed analytics of individual users’ trade history. The team plans to implement one-click trading by Q2 2024, which will provide a significant boost to user experience, especially given the recent heightened gas fees on Base. [33]

9. Business model

Figure 10: IntentX’s business model

Traders on IntentX pay trading fees whenever a leveraged position is opened, closed, or liquidated. At the moment, 100% of trading fees are collected by the IntentX team, with solvers incentivized by token incentives and revenue from order flow. [34] Once the INTX launches, 85% of the total trading fees will be distributed to xINTX stakers. [35]

I anticipate that IntentX will likely begin to take a cut of trading fees as protocol revenue once the protocol has matured and turns its focus from achieving rapid adoption to growing earnings.

10. Team

The IntentX team was founded by the pseudonymous levy and Roux in 2023. [36] In December 2023, levy disclosed that the team consists of 12 core team members with some external designers, with plans to expand aggressively into 2024. [37]

11. Financials

To support its development, IntentX has raised $4.3M from investors, including:

A $2.5M seed round for 20% of total INTX supply from Magnus Capital, Agnostic, Prismatic Capital, etc. [38]

A $1.8M strategic round for 10% of total INTX supply from Selini Capital, Orbs, Mantle Foundation, etc. [39]

Figure 11: IntentX’s INTX token allocation [40]

As a result of the strategic investment from the Mantle Foundation and Selini, INTX will be native to the Ethereum L2 Mantle. [41] Users can most likely look forward to MNT incentives, as well as the current contingent of INTX, CORE, and BLAST airdrops.

All INTX tokens will be vested within 3 years of TGE, roughly in line with competitors like RabbitX and Vertex. [42][43]

Since launch, IntentX has generated ~$350K in trading fees. [44] Fees are accelerating as trading volumes have grown, but have yet to truly reach exponential growth. The Mantle Foundation will likely receive a portion of trading fees in return for their strategic partnership, as Mantle’s Chief Alchemist Jordi Alexander alluded to in his recent appearance on the Bankless podcast. [45]

Figure 12: IntentX’s platform revenue [46]

Conclusion

IntentX is a decentralized perpetual exchange built on Base, Blast, and Mantle. Launched in late 2023, IntentX has facilitated $1.3B in trading volume, with $500M from the previous 30 days alone. I anticipate rapid growth for the protocol due to its wide market support and generous trading reward program, which will be further boosted once one-click trading is implemented on the platform. Major tailwinds are beginning to form as other well-established perpetual DEXs like Aevo and Hyperliquid launch their tokens, and airdrop farmers begin to migrate to newer DEXs.

Overall, due to its strong growth trajectory and advantageous product features, I would strongly consider investing in the INTX token once it has been released. However, investors must remain cautious that 30% of the total supply has been allocated to early investors, and will be vested over just three years.

References

BitMex, XBTUSD: https://blog.bitmex.com/why-xbtusd-is-a-superior-trading-product/

DefiLlama - Derivatives: https://defillama.com/derivatives

DefiLlama - Derivatives: https://defillama.com/derivatives

CoinGecko - Derivatives Exchanges: https://www.coingecko.com/en/exchanges/derivatives

DefiLlama - Derivatives: https://defillama.com/derivatives

Wall Street Journal - FTX: https://www.wsj.com/articles/ftx-says-8-9-billion-in-customer-funds-are-missing-c232f684

GMX - Trading docs: https://gmxio.gitbook.io/gmx/trading

Binance - Trading fees: https://www.binance.com/en/fee/futureFee

OKX - Trading fees: https://www.okx.com/web3/dex-perp/test/market-info/fee

Token Terminal - Transactions per second: https://tokenterminal.com/terminal/metrics/transactions-per-second

GMX - Trading: https://app.gmx.io/#/trade

dYdX - Trading: https://dydx.trade/?utm_source=dydx-website#/trade/ETH-USD

CoinGecko - OKX derivatives: https://www.coingecko.com/en/exchanges/okx_swap

CoinGecko - Binance derivatives: https://www.coingecko.com/en/exchanges/binance_futures

IntentX - Architecture comparison docs: https://docs.intentx.io/on-chain-derivatives-overview/current-on-chain-derivatives-landscape

IntentX - Fees docs: https://docs.intentx.io/additional-information/faq#what-are-the-fees-for-trading-perpetual-contracts-on-intentx

IntentX - Pair list docs: https://docs.intentx.io/intentx-platform/pair-list

CoinGlass - BTC open interest and volume: https://www.coinglass.com/pro/futures/Cryptofutures

IntentX - Analytics: https://app.intentx.io/analytics

IntentX - Analytics: https://app.intentx.io/analytics

IntentX - Analytics: https://app.intentx.io/analytics

CoinGecko - Derivatives Exchanges: https://www.coingecko.com/en/exchanges/derivatives

DefiLlama - Derivatives: https://defillama.com/derivatives

IntentX - Analytics: https://app.intentx.io/analytics

X - IntentX 3-in-1 airdrop program: https://twitter.com/IntentX_/status/1771319369156485155

Aevo - Metabase metrics: https://aevo.metabaseapp.com/public/dashboard/81ee5b91-fbd2-41a5-90dd-d22771425f26

DefiLlama - Derivatives fees: https://defillama.com/fees?category=Derivatives

CoinGecko - DYDX token: https://www.coingecko.com/en/coins/dydx-chain

CoinGecko - GMX token: https://www.coingecko.com/en/coins/gmx

CoinGecko - Aevo token: https://www.coingecko.com/en/coins/aevo

Medium - IntentX and SYMMIO’s strategic partnership: https://medium.com/@IntentX/strategic-partnership-with-symmio-shaping-the-future-of-on-chain-derivatives-9f16d7cc9691

IntentX - Trading architecture flow chart: https://docs.intentx.io/on-chain-derivatives-overview/intentx-solution-and-architecture-overview#intentxs-intent-based-architecture-and-order-flow

X - Base gas fees: https://x.com/base/status/1772767382362055097?s=20

IntentX - Solver docs: https://docs.intentx.io/intentx-platform/intentx-solver-network#stable-deposit-pool-capitalizing-the-solver

IntentX - INTX token utility docs: https://docs.intentx.io/tokenomics/intx-token-and-xintx-staking

IntentX - Team docs: https://docs.intentx.io/additional-information/team-and-partners

YouTube - levy interview with Defi Raiders: https://www.youtube.com/watch?v=ElimMwpvxAs

X - IntentX seed round: https://twitter.com/IntentX_/status/1726974540063162779

X - IntentX strategic round: https://twitter.com/IntentX_/status/1757060889834836259

IntentX - Tokenomics docs: https://docs.intentx.io/tokenomics/token-allocation-and-release-schedule

Medium - IntentX on Mantle: https://medium.com/@IntentX/intentx-on-mantle-the-ascension-phase-b6b53ce29ebd

RabbitX - Tokenomics docs: https://docs.rabbitx.io/token/rbx

Vertex - Tokenomics docs: https://docs.vertexprotocol.com/community-and-tokenomics/vrtx-token-supply-distribution

IntentX - Analytics: https://app.intentx.io/analytics

YouTube - Bankless’ ETH in 2024: https://www.youtube.com/watch?v=0rPF8zNnfnE

IntentX - Analytics: https://app.intentx.io/analytics